The National Payments Corporation of India (NPCI) is implementing new rules for UPI from August 1, 2025, aimed at improving system efficiency, reducing server overload, and minimizing service disruptions, especially during peak hours. These changes will impact all UPI users across various apps like Google Pay, PhonePe, and Paytm.

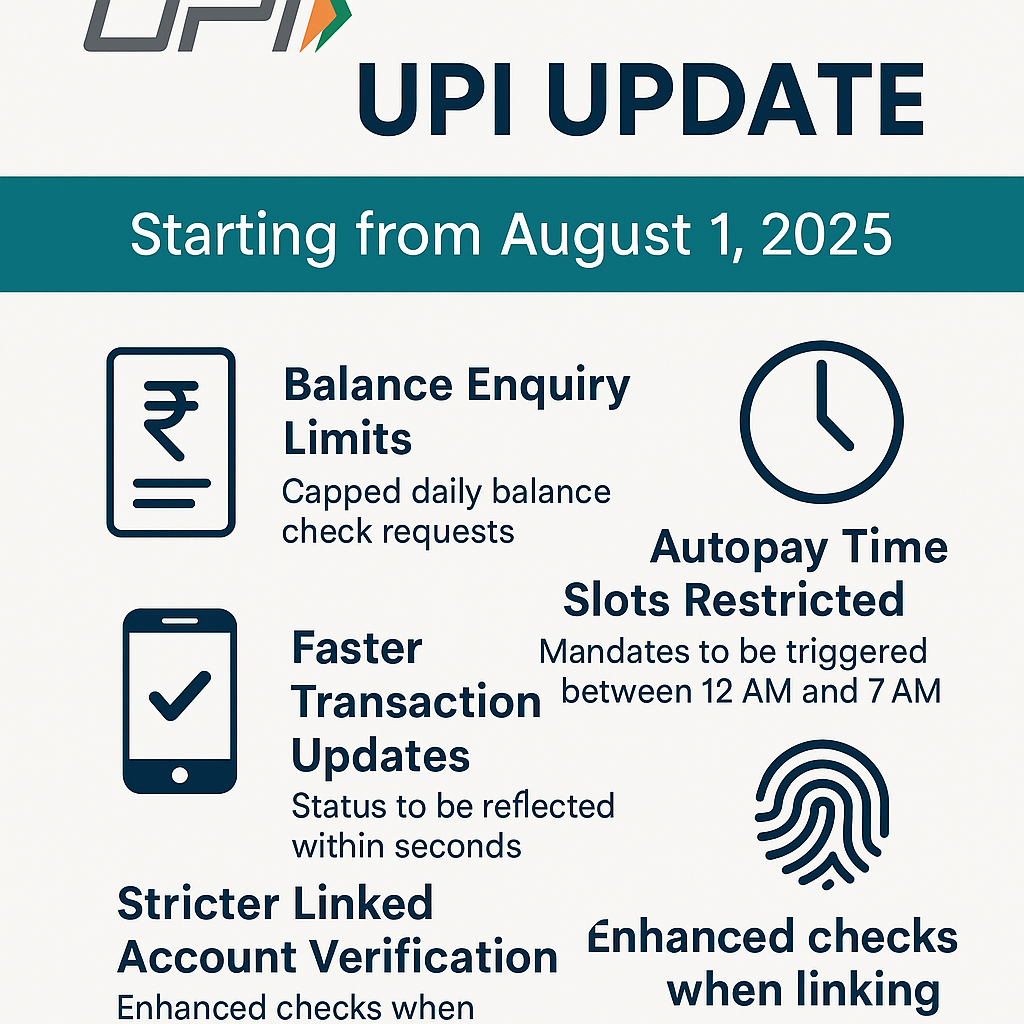

Here’s a summary of the key changes:

1. Daily Limit for Balance Checks:

- You will be able to check your account balance a maximum of 50 times per day per UPI app. If you use multiple UPI apps, this limit applies to each app separately.

- The aim is to curb unnecessary balance-checking that puts a strain on the system.

- UPI apps may discourage or limit balance checks during peak hours (10:00 AM to 1:00 PM and 5:00 PM to 9:30 PM).

- Banks are also mandated to include the available account balance in the confirmation message after every successful UPI transaction, potentially reducing the need for manual balance checks.

2. Limit on Viewing Linked Bank Accounts:

- You can view the list of bank accounts linked to your mobile number through a specific bank in the UPI app only 25 times per day per app.

- This also aims to reduce excessive API calls and ensure smoother service. Explicit user consent will be required for each account check.

3. Scheduled Payments (AutoPay) Timings:

- UPI auto-pay transactions, such as subscriptions, utility bills, EMIs, and SIPs, will now be processed during fixed, non-peak time slots to reduce congestion.

- These windows are generally: before 10:00 AM, between 1:00 PM and 5:00 PM, and after 9:30 PM.

- While this is a backend change, businesses using auto-collect may need to align their processes.

4. Restriction on Checking Failed Transaction Status:

- For any pending or failed UPI transaction, you can check its status only 3 times per day, with a mandatory 90-second gap between each attempt. This is to prevent repeated checks that overload the servers.

- UPI apps are also mandated to show the actual payment status (success/fail) within seconds for all transactions.

5. Transparency in Recipient Details:

- Before confirming a UPI payment, the recipient’s registered bank name will now be prominently displayed. This enhances security and helps prevent mistaken transfers and fraud. (This rule began in June 2025 but is being re-emphasized.)

6. Payment Reversal Requests Cap:

- Users can raise a maximum of 10 payment reversal requests in a 30-day period, with a cap of 5 per sender.

7. Stricter Oversight for Banks and UPI Apps:

- NPCI will closely monitor the API usage by banks and UPI apps. Non-compliance with these new guidelines by July 31, 2025, may lead to penalties, restrictions on UPI API access, or even suspension of new customer onboarding.

What remains unchanged:

- The maximum UPI payment limit itself remains the same (up to Rs 1 lakh per transaction for most cases, and up to Rs 5 lakh for certain categories like healthcare or education).

- These changes are primarily aimed at heavy users and backend optimization, so general users might not notice a significant difference in their daily transactions unless they frequently perform the limited actions.

These new rules are a step by NPCI to make UPI more robust, scalable, and resilient, especially given the massive growth in digital transactions.

Here are the upcoming latest developments in UPI revolution:

Biometric Authentication (Coming Soon)

The NPCI is preparing to enable authentication via facial recognition or fingerprint, which may allow transactions without manual PIN entry—boosting both convenience and security

🌍 International Expansion & Ecosystem Growth

- PayPal World Integration

PayPal has partnered with NPCI and others to link UPI into its PayPal World cross-border payments platform. This will allow Indian users to pay internationally (e.g. U.S. shopping) directly via UPI, expanding UPI reach to 2 billion+ global users. - Global Adoption & Partnerships

NPCI is engaging with countries in Africa and South America to replicate UPI-like systems. The UPI One World service, already available for select international travelers, is part of this effort

💰 Sustainability & Policy Outlook

- The RBI Governor has highlighted the need for a sustainable financial funding model to support UPI’s continued expansion, warning of potential infrastructure strain amidst rapid growth.

- Meanwhile, the government has confirmed that no GST will be imposed on UPI transactions above ₹2,000, reinforcing tax-free access to digital payments and encouraging adoption

✅ Quick Overview

| Area | Key Update |

|---|---|

| Volume & Growth | ₹24 lakh crore monthly, ~18 billion transactions/month (July 2025) |

| Aug 1 Rule Changes | Limits on balance checks, timed autopay, faster status updates, account verification |

| Security Upgrades | Biometric authentication in the pipeline |

| Global Reach | Integration via PayPal World, global adoption initiatives |

| Policy Support | No GST on high-value UPI transactions; RBI pushes sustainable financing |

🧭 What This Means for You

- Users: You might notice smarter autopay scheduling, fewer repeated balance checks, and faster clarity on transaction outcomes.

- Consumers: Using UPI abroad (especially via PayPal) should become smoother and more accessible.

- Merchants & App Providers: Backend systems need to adapt to API rules, stricter account linking, and faster feedback loops.

- Fintech and Regulators: Coordination is needed to ensure UPI continues scaling without compromise to performance or sustainability.

Leave a Reply